Stock prices were up across the board for the week while bond prices were mixed. The Fed Funds futures are now implying a 61% chance that the next rate hike will come in July (up from a 53% chance last week) according CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

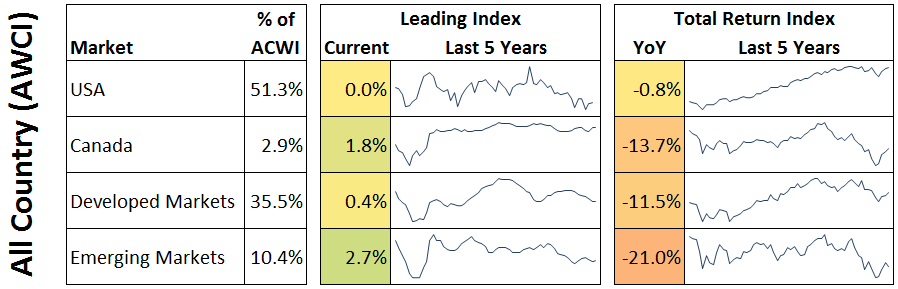

The Leading Indicator for International Developed Markets (EFA) increased by 0.02% percentage points to 0.53%. The Leading Indicator for International Emerging Markets (EEM) decreased by 1.17% percentage points to 2.01% after large revisions to the Conference Board's Leading Indicator for China. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.